When you decide to take out a mortgage to buy a home, there are many factors that affect the overall cost of the loan, not only the loan amount and interest rate, but also many other factors. One of the important factors is the mortgage-related fees that you need to understand. Understanding these fees will help you be better prepared financially, avoid surprises, and facilitate the entire loan process. Below is detailed information about mortgages and related fees.

1. WHAT IS A MORTGAGE?

A mortgage is a loan that a borrower (usually a home buyer) receives from a bank or financial institution to buy real estate. This loan is secured by the property you are buying, meaning that if you default on the loan, the bank has the right to repossess the property to recover the loan amount.

Mortgages usually have terms regarding interest rates, loan terms, and fees. Interest rates can be fixed or variable depending on the type of mortgage you choose. The loan term can range from 5 to 30 years, depending on your financial capacity and the bank’s choice.

2. COMMON TYPES OF MORTGAGES

There are many different types of mortgages that you can choose from. Each type has its own characteristics and is suitable for different financial needs.

FIXED MORTGAGE

This is the most common type of mortgage, with an interest rate that does not change throughout the term of the loan. You will pay a fixed monthly amount, making it easier to budget and manage your personal finances. However, fixed mortgage interest rates are usually higher than variable mortgages.

VARIABLE MORTGAGE

Variable mortgages have interest rates that change over time, usually depending on the market’s prime interest rate. In the early years, variable mortgage rates may be lower than fixed mortgage rates, but over time, interest rates may increase, resulting in changes to your monthly payments.

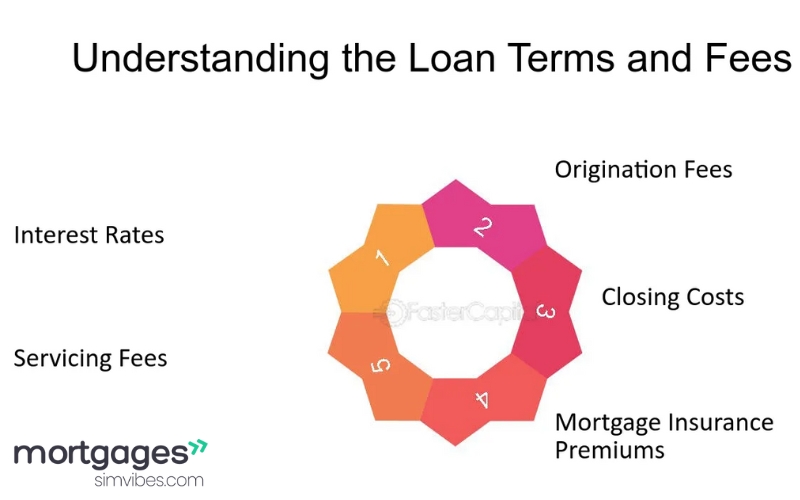

3. MORTGAGE FEES

In addition to the principal amount and interest rate, there are a number of other fees you should be aware of when taking out a mortgage. These fees can increase the total cost of the loan and affect your budget over the life of the loan.

MORTGAGE FEES

These are the fees you will pay when you open a mortgage, and they typically include appraisal fees, processing fees, and other costs associated with the loan. While banks may include some of these fees in the total loan amount, you still need to be prepared to pay these fees when you sign the loan agreement.

Appraisal fee: The bank will require an appraisal of the property you are purchasing to ensure that it is of sufficient value to secure the loan. This appraisal fee can vary depending on the value of the property and the appraisal firm the bank uses.

Processing fee: This is the fee you pay for the bank to process your loan application, including checking your financial records and confirming other necessary information.

INSURANCE FEES

When you take out a mortgage, you may need to pay insurance, especially if your loan is more than 80% of the value of the property. This protects the bank in case you cannot repay the loan. Common types of insurance are property insurance and mortgage insurance.

Property insurance: Protects the bank and the borrower in case of property damage, fire or natural disaster.

Mortgage insurance (PMI): If you do not have enough money for a down payment, the bank may require you to purchase mortgage insurance to reduce your risk. This insurance can increase your borrowing costs.

TRANSFER FEES AND CLOSING FEES

When you complete the mortgage process and transfer the property, you will be charged some transfer fees and closing fees. These fees may include:

Transfer fee: This is the fee associated with transferring ownership of the property from the seller to the buyer.

Signing fee: This is the fee you pay for legal services related to signing the mortgage contract and ensuring the legality of the procedures.

EARLY REPAYMENT PENALTY

One important thing to note is the penalty if you pay off your mortgage loan early. Banks often apply this penalty if you pay off your loan within a certain period of time, usually within the first 2 to 5 years of the loan. This helps the bank protect its interests against losing interest on the loan.

SERVICE FEES

Banks and financial institutions may also charge service fees throughout the mortgage loan process. These fees may include account management fees, information change fees, and other fees associated with managing the loan.

4. FACTORS THAT AFFECT FEES

Many factors can affect the mortgage-related fees you pay. These include:

DEPOSIT SIZE

If you can put down a large amount (usually 20% or more), you may be able to reduce some fees such as mortgage insurance (PMI) and other insurance fees. The larger the down payment, the more you have an advantage in reducing your overall costs.

MORTGAGE TYPE AND INTEREST RATES

The type of mortgage you choose (fixed or variable) will also affect the fees you pay. Fixed-rate mortgages typically have higher mortgage origination fees, but you won’t have to worry about interest rates rising over the life of the loan. Meanwhile, variable mortgages may have lower opening costs but the interest rate may change over time.

LOAN TERM

The length of the loan also affects the overall cost of the loan. Longer-term loans typically have higher fees due to the longer loan term, but you will be able to make lower monthly payments. On the other hand, shorter-term loans reduce the total interest cost but require a larger monthly payment.

5. CONCLUSION

Getting a mortgages to buy a house is a big decision and requires careful preparation. Not only do you need to pay attention to the loan amount and interest rate, but you also need to understand the fees associated with the mortgage so you can calculate the overall cost and plan your finances properly. Understanding these fees will help you avoid surprises and create a solid financial foundation throughout the loan process.