Mortgage interest rates are one of the most important factors when deciding to borrow money to buy a house or real estate. Interest rates directly affect the amount you have to pay each month as well as the total cost you will have to pay over the life of the loan. Understanding the factors that affect mortgage interest rates will help you make the most informed and optimal borrowing decisions. This article will describe in detail the factors that affect mortgage interest rates, helping you better understand how interest rates are determined and how to adjust them.

1. CENTRAL BANK’S BASE INTEREST RATE

One of the important factors that affects mortgage interest rates is the base interest rate decided by the Central Bank. The base interest rate, also known as the official interest rate, is the interest rate that the central bank applies to commercial banks when borrowing from each other. This interest rate directly affects the cost of borrowing for banks and thus affects the interest rate that borrowers have to pay.

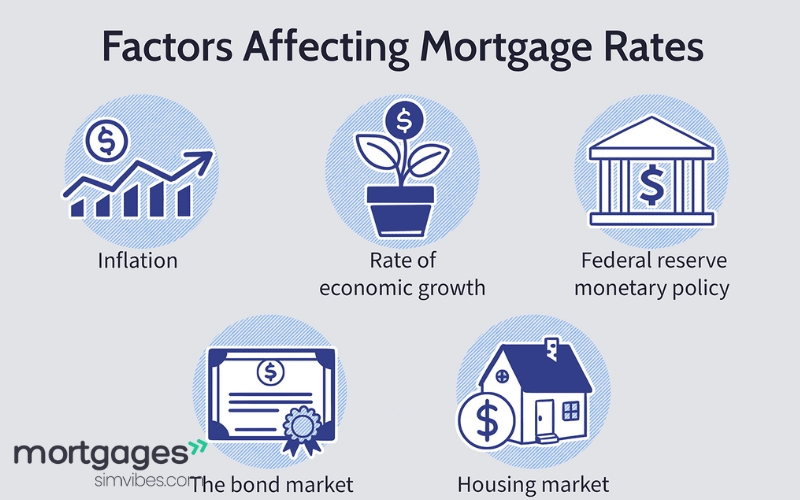

When the Central Bank decides to change the base interest rate, commercial banks will adjust the interest rates on mortgage loans to reflect this change. For example, if the Central Bank increases the base interest rate, commercial banks will tend to increase mortgage interest rates to protect profits. Conversely, when the Central Bank reduces interest rates, mortgage interest rates may also decrease.

2. GENERAL ECONOMIC SITUATION

A country’s economic situation has a direct impact on mortgage interest rates. During periods of economic growth, when businesses are growing strongly and personal incomes increase, the demand for loans often increases. This can lead to an increase in mortgage interest rates to control inflation and maintain economic stability.

Meanwhile, during economic recessions or when the economy is in trouble, banks and financial institutions often reduce interest rates to encourage borrowing and investment. At that time, borrowers will have the opportunity to access loans with lower interest rates, helping to reduce financial pressure.

3. PERSONAL CREDIT SCORE

A borrower’s personal credit score is one of the important factors affecting mortgage interest rates. A credit score is an indicator of your ability to repay debts in the past, and banks use this credit score to assess the level of risk when lending.

People with high credit scores are often considered less risky, so they can enjoy lower interest rates when borrowing mortgages. Conversely, if your credit score is low, the bank can apply a higher interest rate to compensate for the higher level of risk. Therefore, maintaining a good credit score is important to be able to access loans with favorable interest rates.

4. MORTGAGE TERM

The term of the mortgage is an important factor that affects the interest rate you pay. Longer-term loans (usually 20 to 30 years) usually come with higher interest rates than shorter-term loans. This is because banks may take a greater risk in case the borrower fails to make payments on time over a long period of time.

If you take out a short-term mortgage, you may get a lower interest rate, but your monthly payments will be higher because of the shorter term. Conversely, if you take out a longer term, although you may reduce your monthly payments, you will end up paying more overall because of the higher interest rate.

5. TYPE OF MORTGAGE (FIXED OR VARIABLE)

The type of mortgage you choose also affects the interest rate you pay. Fixed mortgages have an interest rate that remains the same throughout the life of the loan, making it easier to plan for your long-term finances. However, the interest rate on this type of mortgage is usually higher than that on variable mortgages.

Variable mortgages have an interest rate that changes over time, usually starting at a lower rate but can change as the market fluctuates. The interest rate on this type of mortgage can decrease when the market is down, but it can also increase when the market changes unfavorably. Therefore, although variable mortgages can save money in the short term, they also have risks if interest rates rise sharply.

. DOWN PAYMENT

The amount of deposit you pay when taking out a mortgage also affects the interest rate you will pay. Typically, if you pay a large deposit, the bank will consider you a less risky customer and may lower your interest rate. This is because you have reduced some of the risk to the bank when your loan has a low loan-to-value ratio.

If you can only pay a small deposit, the bank may require you to pay a higher interest rate to compensate for the higher financial risk. Typically, if you put down less than 20% of the property’s value, you may be required to pay private mortgage insurance (PMI) to protect the bank in case you are unable to repay the loan.

7. SUPPLY AND DEMAND OF LOANS IN THE MARKET

The supply and demand of loans in the market also affects mortgage interest rates. When there are many people who want to borrow money but the amount of capital available from financial institutions is limited, banks will increase interest rates to reduce demand for loans. Conversely, if the market has many sources of loans, interest rates may decrease to stimulate borrowers.

8. POLICIES OF BANKS AND FINANCIAL INSTITUTIONS

Banks and financial institutions may also apply their own policies in determining mortgage interest rates. This policy may involve factors such as promotions, special loan packages, or other loan conditions. If you have a good credit profile and banks are running promotions, you may receive lower interest rates than market conditions.