When you are looking for a mortgage to buy a home or property, choosing between fixed and variable mortgages is an important decision. Each type of mortgage has its own benefits and drawbacks, and the right choice depends on your financial situation and long-term plans. This article will analyze the benefits of fixed and variable mortgages in detail, helping you make an informed decision.

1. BENEFITS OF FIXED MORTGAGE

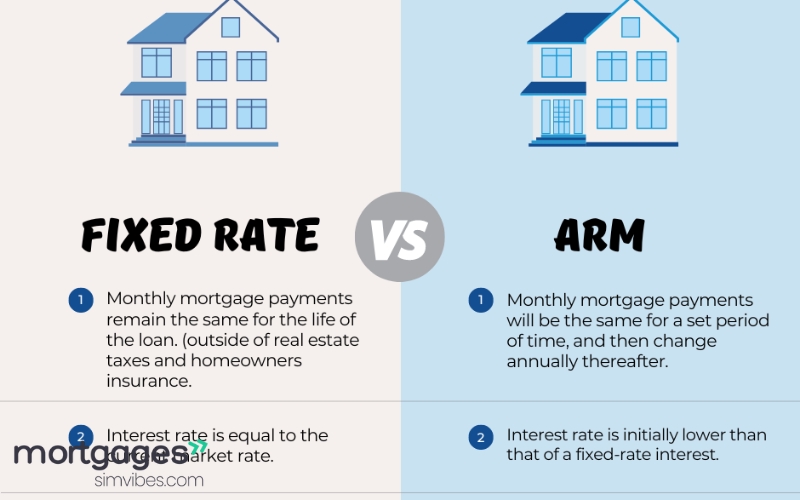

A fixed mortgage is a type of loan with an interest rate that does not change throughout the loan term, giving the borrower stability and ease in calculating monthly payments. Here are the key benefits of fixed mortgages:

INTEREST RATE STABILITY

One of the biggest benefits of a fixed mortgage is that the interest rate will not change throughout the loan term, regardless of economic conditions or market interest rates. This gives borrowers peace of mind because they can accurately predict their monthly payments, making it easier to plan their long-term finances. Not having to worry about interest rate changes gives borrowers the confidence and stability to manage their expenses.

EASY FINANCIAL PLANNING

With a fixed mortgage, borrowers can easily plan their finances because their monthly payments are always fixed. This is important for those who have a stable income and do not want to face unexpected changes in their budget. Knowing the amount of money they will have to pay each month helps borrowers manage other expenses such as living expenses, savings, or investments.

PROTECTION FROM ECONOMIC FLUCTUATIONS

When financial markets are unstable, especially during periods of rising interest rates, fixed mortgages help protect borrowers from these fluctuations. If you take out a fixed-rate mortgage, you won’t have to worry about interest rates rising and increasing your financial burden. This is especially helpful if you’re borrowing during a period of low interest rates and want to keep your payments steady over the life of your loan.

LONG-TERM PRIORITY

If you plan to live in the home you’re borrowing to buy for a long time, a fixed mortgage may be the best option. You won’t have to worry about refinancing your loan or worrying about interest rates changing, so you can focus on taking care of your family or work without worrying about financial factors outside your control.

2. BENEFITS OF VARIABLE MORTGAGE

A variable mortgage (or variable-rate mortgage) is a type of loan where the interest rate changes over time, usually based on an index such as the Federal Reserve’s interest rate. Although this type of loan is more volatile than a fixed mortgage, it also offers some distinct benefits:

LOWER INTEREST RATES INITIALLY

One of the major benefits of variable mortgages is that the initial interest rate is typically lower than that of a fixed mortgage. This can save the borrower a significant amount of money in the early years of the loan. If you are financially sound and plan to pay off the loan in a short period of time or want to refinance the loan in the future, a variable mortgage can be a good option.

SHORT-TERM SAVINGS

With a low interest rate in the early stages, the borrower can save money on finance charges in the early years. This is especially helpful if you plan to sell the property or refinance the loan before the interest rate adjusts. Plus, if interest rates don’t rise significantly over the life of your loan, you could save a significant amount of money compared to a fixed mortgage.

SAVING OPPORTUNITY WHEN INTEREST RATES FALL

One of the benefits of variable mortgages is the ability to save when interest rates fall. If the financial markets are trending lower, borrowers will benefit from lower interest rates and lower borrowing costs. This can be especially useful during economic downturns or when the Federal Reserve cuts interest rates.

FLEXIBLE OPTIONS

Variable mortgages often offer more flexibility than fixed mortgages. In many cases, borrowers can refinance their loan or change the terms of their contract if interest rates move in their favour. This allows borrowers to tailor their financial plans to suit their circumstances.

3. COMPARE FIXED AND VARIABLE MORTGAGES

Each type of mortgage has its own advantages and disadvantages, and the right choice depends on your needs and financial plan. If you prefer stability and do not want to worry about changing interest rates, a fixed mortgage may be the best choice. However, if you can tolerate volatility and want to save money in the early stages of the loan, a variable mortgage may be the right choice.

The choice between a fixed and variable mortgage also depends on your risk tolerance. If you do not want to face any financial uncertainty, a fixed mortgage will give you peace of mind. On the other hand, if you are willing to accept changes in interest rates and want to take advantage of savings opportunities, a variable mortgage will be financially beneficial.

4. CHOOSE THE RIGHT MORTGAGE

To make the right decision, you need to consider factors such as income, ability to pay, expected length of stay in the home and personal financial situation. You should also consult with mortgage consultants to better understand the terms and interest rates of each type of loan.